By: Darren W. King | Wealth Management

Source: Bloomberg, Inc.

Key Takeaways:

Equity Strategy

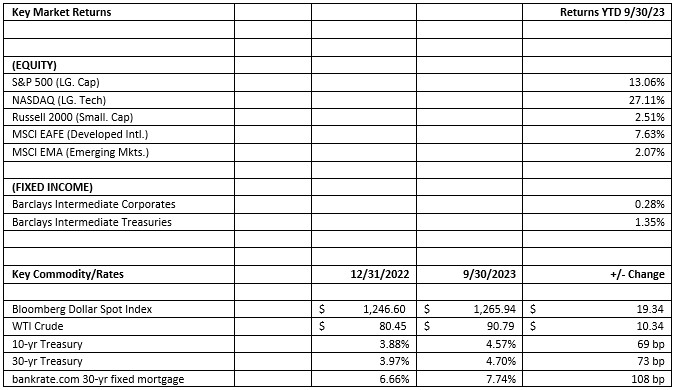

Equity markets posted negative returns in the third quarter as rising interest rates took some steam from the 2023 equity rally. Stock market levels are trading at roughly the midpoint between early January 2022 market highs and October 2022 lows. The key to a bottom in this equity correction will be stabilization in the extreme volatility that interest rates have experienced since August of this year. Since August 1st, the 10-year treasury has risen from 4.1% to 4.74%, and the S&P 500 has corrected 7% following this move in interest rates. Investors are starting the believe the Fed’s intentions to keep interest rates higher for longer.

Fixed Income Strategy

While interest rates fell during the first half of the year and the bond market was pricing for recession and interest rates cuts in 2023; the bond market rally has evaporated, and investors are now seeing a much tougher road to moving inflation back down to the fed’s 2% target. Following these developments, the 2-year treasury started 2023 at 4.43% and has risen to 5.05% today (October 4). The 10-year treasury has risen from 3.88% at year end to 4.74% today, while the 30-year treasury has risen from 3.97% to 4.88% today. The Fed now sees the fed funds rate hitting 5.50-5.75% by year end 2023, while remaining above 4.0% well out to 2025. The Moody’s Seasoned “A” Corporate Bond yield, currently at 6.02%, is at the highest levels seen in a decade, right back to the peak in interest rates that occurred in October of2022. In our opinion, the fixed income markets offer yields that provide an alternative to equity only investing that has not presented itself in the last decade’s low interest rate environment and would provide a hedge to any severe equity market correction and recession selloff. In such a scenario, the fed would lower rates sooner and bond prices would provide some cushion to any equity losses.

Click here to read the entire Q3 2023 Market Review.

Non-Deposit Investment Services are not insured by FDIC or any government agency and are not bank guaranteed. They are not deposits and may lose value.